The U.S. Census Bureau has released its “individual unit” state and local government pension fund data for FY 2014 and FY 2015, and based on past practice I probably would have used it to update my databases, produce a bunch of charts, and write a post or two. But comparing these years with the years preceding, it seems that the data has been trashed. This is something I feared after union-backed Comptroller Stringer’s election, reformed sinner actuary Robert North’s departure, and the imposition of somewhat stricter reporting requirements by the Government Accounting Standards Board, which show more clearly just how underfunded public employee pension funds are.

The new problem is in the Census Bureau data for the NYC Teachers Retirement System, joining the problem I had already found in data for the NYC police retirement system. I learned in government to never assume a conspiracy when a foul up is an equally credible explanation. Whatever the cause, however, if a fix is to be made the Census Bureau nonetheless will not be updating the 2014 and 2015 public employee data until the 2016 data is released next year. So I’ll probably wait to write about NY and NJ public employee pensions again until then.

I knew a problem was coming, by accident or design, when I glanced through the Teacher’s Retirement System of the City of New York Comprehensive Annual Financial Report 2014. On page 1.1, that report (the first released during the Administration of NYC Comptroller Scott Stringer) said:

“This is our first system-wide Comprehensive Annual Financial Report, covering both the QPP (Qualified Pension Plan) and the TDA Program (Tax Deferred Annuity). In the past, TRS’ Comprehensive Annual Financial Reports covered only the QPP; the TDA Program was covered in a separate section of TRS’ Annual Reports (published separately).”

“Issuing a system-wide report allows us to portray all the activities of our retirement system. Additionally, the report’s system-wide financial statements also allow us to better describe how assets of the QPP and TDA Program are co-invested.”

The TDA program is the equivalent of a 401K that teachers can contribute to, in order to later get retirement income in excess of their pensions. It is the teachers’ own money, not money that could be used to pay pension benefits. According to page 2.1, the pension system’s auditor felt the need to specifically bless (or at least not curse) this change in reporting.

“In 2014, the City determined that it was preferable to present the System’s financial statements on a combined basis for presentation purposed for inclusion in The City of New York Comprehensive Annual Financial Report. Therefore, the System will no longer report on an individual basis the QPP and TDA Programs and will report the two on a combined basis. As a result, the System’s 2013 financial statements were restated to conform to this change.”

The auditor’s opinion that the financial statements correspond to generally accepted accounting principles “is not modified with respect to this matter.”

So what changed? Under the TDA program, NYC teachers are guaranteed a 7.0 percent return on their own extra retirement investment – vastly higher than the rate anyone else could get in this low interest rate, high debt, post Generation Greed environment. How this could ever be thought of as fair escapes me, but like many other similar deals it probably dates to the stock market bubble of 1982 to 2000.

The United Federation of Teachers probably claimed that the pension plan had “excess money,” the same claim used to justify retroactive pension increases, and asked for a share. It is as if someone had guaranteed you an increase of 7.0% per year not from a normal years, but from the peak of the dot.com mania in 2000, with the right to force other people to pay as much as it took to honor that guarantee. In exchange for – probably political support decades ago. Noted page 2.9.

“Payment of statutory interest due to the TDA from its investment in the pooled NYC Pension Assets during Fiscal Year 2014 were $1.1 billion, an increase of $99.9 billion from Fiscal Year 2013. Payments of statutory interest due to the TDA from its investment in pooled NYC Pension Fund assets (Fixed Return Fund) during Fiscal Year 2013 were $1.0 billion, an increase of $102 million from FY 2012. As noted under benefit payments, these amounts were included in prior fiscal year financial statements as a component of QPP Benefit payments.”

That is, in addition to actual payments from the pension fund to retirees, you had payments to the 401Ks of active and retired teachers, to make up for rates of return below 7.0%. Before 2014 this was a retirement benefit paid that was reported as a retirement benefit paid. How is this $1 billion reported now? Looking at the table on page 2.8, instead of money paid out, it appears to be counted as money that didn’t go into the pension fund. Negative “additions” to the fund.

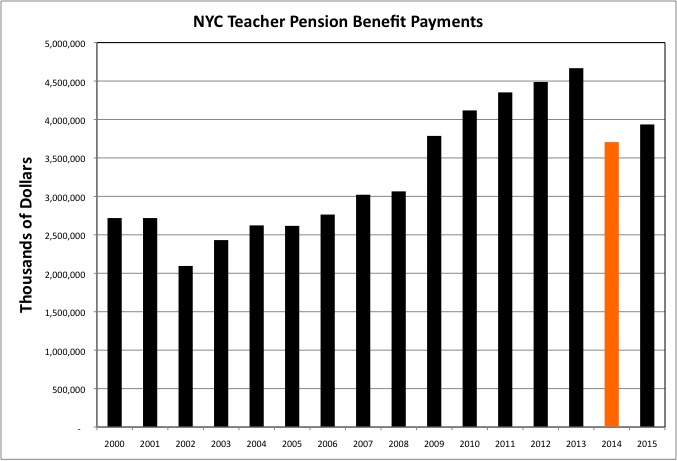

The effect on the Census Bureau data is shown in this chart, as $1 billion in benefit payments disappears.

It should be noted that according to the Census Bureau’s government finances manual, “benefit payments” (code X11) includes

“Cash payments to, or on behalf of, participants for retirement benefits and annuities, death and disability benefits, life and disability insurance on behalf of retirees, pre-retirement death benefit premiums, benefits due on termination of employment, survivors benefits, and other benefits as allowed.”

Perhaps the TDA payments, based on the manual, should be counted as public school expenditures but not as pension payments at all, except that they are somehow connected with the pension system.

So why, in the city’s reporting, does data for the TDA, the private savings of teachers invested with the city, have anything to do with the NYC teacher pension plan at all? There is perhaps $22 billion in TDA savings. Imagine that the investment return for one year was minus 33 percent, as the latest bubble generated by rock bottom interest rates once again deflated. In theory NYC would owe teachers’ 401Ks something like $8.8 billion that year alone, causing bankruptcy. But instead, what appears to be happening is that the city is taking the money for the 401Ks out of the pension fund, reducing the money available to pay pension benefits. As noted on page 2.27

“Assets in the TDA Fixed Return Fund are invested with the assets of the QPP, on a pro rata basis consistent with the QPP’s asset allocation policy. Earnings on these investments over (or under) the Statutory rates are considered by the Actuary in determining employer contributions to the QPP, such that the City is ultimately responsible for any deficiency.”

So taxpayers are required to pay up for the 7.0% return not immediately, but into the indefinite future, which appears to be what is happening, by having to pay more into pension fund. Is that even legal, given that under the state constitution public employee pensions may not be “impaired?” Moreover, it isn’t “the City” that has to pay. It is people who live and work in the city and have less political power that are actually required to pay the amounts owned, regardless of the consequences, in higher taxes and service cuts.

So if the payments from the pension plan to the TDA are not being counted as retirement benefits, where are they being counted? In Census Bureau data they appear to have disappeared – unless they are being deducted from investment returns. Based on the Census Bureau data for the NYC police pension fund, that may be the case.

The NYC police got a special pension deal in excess of the actual pensions they were owed as well. In years when their pension fund’s rate of return exceeded the “expected” level, they got a special pension bonus due to “excess” returns. And then the next year when pension returns were below expectations, taxpayers were made to make up the difference – increasing taxpayer costs even if over the long term the expected returns were achieved. This is the exact deal that so outraged people when it was disclosed in the Detroit bankruptcy, with retirees forced to pay back all their “Christmas bonuses” previously awarded by union-controlled pension boards in lower benefits in the future.

Some time in the 1990s, that extra pension payment in years of “excess returns” was converted to a guaranteed extra $12,000 pension payment to every retired officer every year, whether the pension fund earned money or lost it. Basically police pensions are $12,000 per year higher than the police and politicians say they are. That is also the case for many police officers and firefighters. So how does that money show up in Census Bureau data? Not as pension benefit payments, even though taxpayers are paying and retired officers are getting.

As I wrote last year the Citizen’s Budget Commission looked into it, and got the answer.

http://www.cbcny.org/cbc-blogs/blogs/christmas-bonuses-uniformed-retirees-weaken-city’s-pension-funds

“On December 15th, about 41,600 retired New York City police, fire, and correction officers will receive a $12,000 check. This payment, known as the Variable Supplement Fund (VSF) payment and informally referred to as the “Christmas bonus,” is made annually to eligible retirees in addition to their regular pension. These payments will total approximately $500 million in 2014. VSF payments are not only a benefit typically not available to retired officers in other jurisdictions, they also are a drain on the fiscal health of the pension funds.”

So instead of reporting that former police officers receive a pension that includes an extra $12,000, the police pension fund reports that its investments returned $500 million less than they actually did. This explains the presumed error I found in the Census Bureau data – the rate of return on the NYC Police Pension fund over the long term was just 4.6% — far less than any other pension fund.

So when Comptroller Stringer reports the rate of return achieved on the NYC teacher pension fund over the past year, will he do so based on returns minus the $1 billion payment by the teacher pension fund to the TDA? Thus making that return seem lower than the returns for comparable plans elsewhere. Or just report the $1 billion as being subtracted from investment returns for purposes of Census Bureau data, with the difference between the two making the $1 billion seem not to exist? Is the plan to make this $1 billion and rising payment just not show up anywhere? And for how long will be paying?

A long time, according the NYC TRS CAFR itself, on page 2.44.

The expected rate of return was 7.0% before 2000, was 8.0% from 2000 to 2009, and is now 7.0% — the same as the guaranteed rate for the TDA plan. But the actual expected rate of return based on “reality” is given in the report as 5.33%, and that is assuming a 9.9% return on private equity (a ripoff by those who run private equity funds is more likely) and 7.9% for emerging market equities (which have subsequently crashed). That 5.33% is also quite high starting from the current inflated stock, bond and real estate prices. Anyone want to guarantee me that? How about 4.0%? Certainly not.

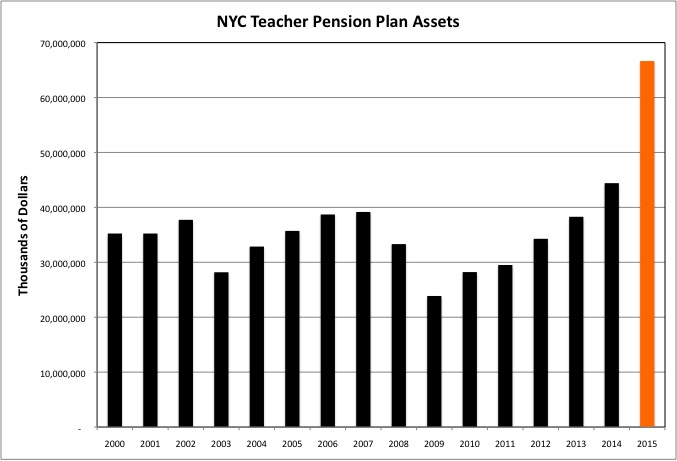

Meanwhile, based on this “combined reporting” another problem cropped up in 2015 Census Bureau data, with all the teachers’ own money in their TDA showing up as pension assets!

Suddenly, according to this data, NYC TRS is not only paying out $1 billion less per year than a couple of years ago, but also it has $66 billion instead of $44 billion more in the till!

All that has to happen now is for the Fiscal Policy Institute to use this data and issue a report saying that the NYC pension crisis is over, and was probably a hoax to begin with, based on those lower benefit payments and higher pension assets. For the New York Times to use the report as the basis of a front-page story. For the UFT to use the Times story to claim the pension plan is over-funded, and to demand more retroactive pension increases that “cost nothing” as a result. And for all these – and Comptroller Stringer — to subsequently not discuss the NYC pension plan at all once the data is fixed, leaving the false impression they want to leave.

Now I could use the NYC TRS CAFR to try to correct the NYC data (and the NY State and U.S. totals) back to the kind of reporting they used to have, and write my post. But as the public employee pension crisis rolls on, the political incentive to lie and cheat becomes greater and greater everywhere, not just here. Particularly in the wake of the GASB revisions. So I can’t be sure about the Census Bureau data from other places either, and will wait for more confirmation of what might be going on.

How desperate are members of the political/union class. This is one of the worst I’ve heard.

http://madisonrecord.com/stories/510965246-illinois-diverts-federal-funds-from-teachers-to-trs

“Unlike their counterparts in other states, Illinois school districts pay a steep premium to the Teachers’ Retirement System, or TRS, if they use Title I federal money to hire teachers.”

“Districts are assessed 36.06 percent of salaries paid with federal Title I funds, and that is set to increase to 38.54 percent for the 2016-2017 school year. By comparison, the rate for a district not using Title I money is and will remain 0.58 percent.”

“So a district using Title I money to hire a teacher at $50,000 a year would fork over $19,270 to TRS, but the tab for a district paying a teacher the same salary out of state and local funds would be $290.”

“To paraphrase U.S. Rep. Robert Dold, taxpayers from across the nation are pouring vast sums into Illinois’ teacher pension-debt quagmire. And the biggest losers? The very ones the Title I money is intended to aid – low-income students.”

Last I checked the taxpayer pension contribution to NYC TRS for New York City teachers was around 40.0% of payroll.

The reason the rate is so low for new non-Title 1 teachers in Illinois is that a union-controlled Democratic Governor and state legislators enacted the mother of all “screw the newbie, flee to Florida” schemes. With new teachers there not only not getting Social Security, but also paying around 100 percent of the total cost of their radically less generous pensions. To offset the retroactive pension increases and taxpayer pension underfunding of the Generation Greed era.

All new teachers are presumably on the same end of this screw the newbie, flee to Florida deal whether supported by federal money or not. So the actual cost of their pensions will be the same. But somehow the pension plan is still gouging poor districts hiring new teachers funded with federal money with an assessment at close to 40.0% into the pension fund.

How can this be legal? It sounds like the theft of federal funds, something that might happen in New York’s Medicaid program.

In any event, its going to be “wait until next year” when it comes to updating my database of public employee pension data in NY, NJ and elsewhere based on the Governments Division of the U.S. Census Bureau. Hopefully I’ll have something for you in the summer of 2017. Or I’ll be writing a much angrier post in the summer of 2017. Hmmm, what else is going to be going on in 2017?

In any event, if you haven’t read it before here is an analysis of the public employee pension data for all the pension funds in each state (grouped together, not individually) and for NYC separate from the rest of the state, over 40 years.

Sold Out Futures: Public Employee Pensions, Census of Governments Data