Author: Larry Littlefield

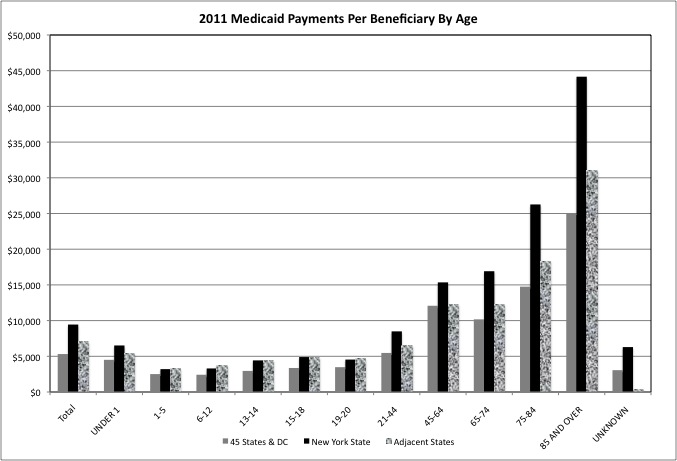

Medicaid By State and Age in 2001 and 2011

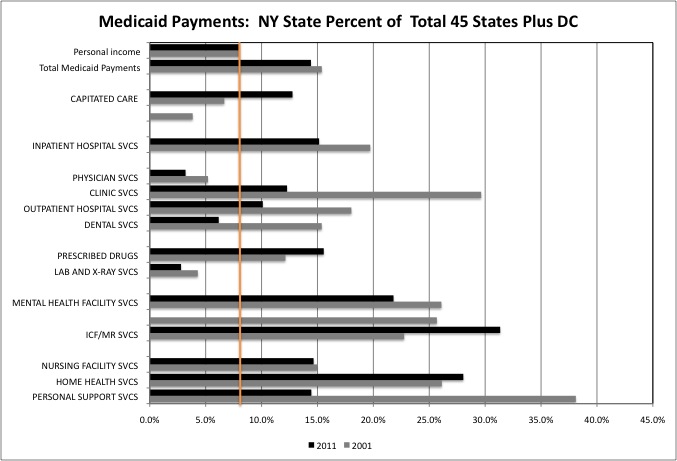

|Medicaid By State and Type of Service in 2001 and 2011

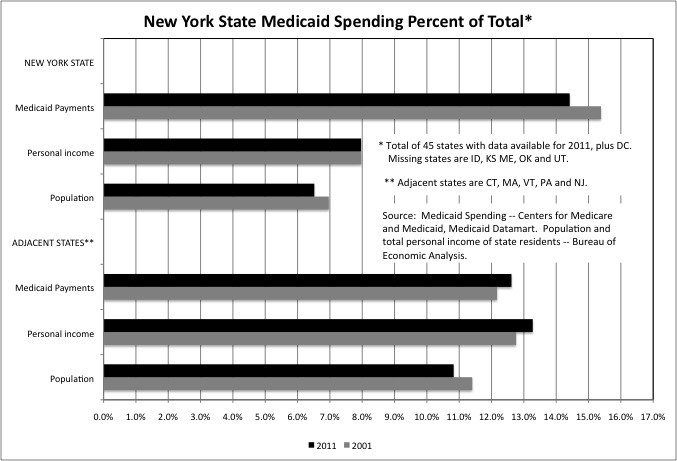

|Medicaid By State in 2001 and 2011

|How Then Shall We Live Reprised

|This week I am reposting the series “How Then Shall We Live” about personal economics in the wake of Generation Greed on “Saying the Unsaid in New York.” Since I wrote these posts in2012, at a time when Room Eight was down much of the time, those who have read my posts over the years may not have seen them. The first post in the series is here.

http://larrylittlefield.wordpress.com/2014/08/23/repost-how-then-should-we-live-thoughts-on-possible-adaptations-in-household-economics-in-the-wake-of-generation-greed/

Preparing for Institutional Collapse

|Over the next week, I'll be reprising my Room Eight posts on this topic, with some additional commentary added, on Saying the Unsaid in New York. You can read the originals by searching for my name, Room Eight, and "institutional collapse."

Generational Equity and the Legacy of Today’s Politicians: Update

|I’ve repeated and written some updates for this Room Eight post

http://www.r8ny.com/blog/larry_littlefield/generational_equity_and_the_legacy_of_today_s_politicians.html

On “Saying the Unsaid in New York.”

http://larrylittlefield.wordpress.com/2014/08/10/generational-equity-and-the-legacy-of-todays-politicians-update/

The Dog Days Plan

|My blogging plan for the month of August is to take a bit of a break while building up another database to write about. I plan to re-post some essays on “Saying the Unsaid in New York” that were originally posted on Room Eight some time ago, while adding in some additional updates based on changes between then and now (in italic after the word “Update”). Most of the essays, if not the updates, can already be found as MS Word documents linked from the “Helpful Background and Greatest Hits” page, but I want to repost them anyway so it is easier to direct people to them, and more likely that they will come up in searches. I find, using information available to me on Wordpress, that many people are reading items I posted last year, not just the stuff I put up in the past week. So there is an advantage to having things on the main page.

Although I will be re-posing some of my Room Eight items, I remain grateful for those who created and maintain that site for first giving me an opportunity to blog, and keeping all the posts I have written available. I have no way of knowing how many people are continuing to read what I post there, but anecdotal evidence suggests that at one time, at least, the number reading there was substantial, and included some in what I hoped to be the target audience. Those who read all my Room Eight posts over the years probably will see no need to re-read the items I will be posting on Saying the Unsaid In New York this August. If I come up with something else over the next few weeks, however, I’ll post it on Room Eight as well.

Pensions the Nature of the Lie II

|Last November I wrote a post called “Pensions The Nature of the Lie.” The post described the way politicians have used the double counting of asset price bubbles and historically average rate of returns to justify retroactive pension increases for politically powerful public employee unions, and cuts in taxpayer pension funding to shift money to other interests. With the bill shifted to the less powerful, less well off others when the bubbles inevitably deflate. In the post I predicted that if the most recent asset price bubble, driven by the sub-zero interest rate policy of the Federal Reserve, did not deflate by the end of the fiscal year, the new local liar in chief City Comptroller Scott Stringer would announce how great things are based on market values. And if it did deflate, he would claim that things were still fine based on actuarial values, which do not account for short-term market moves in either direction until years later.

The bubble has not yet deflated. According to one widely accepted set of measures, it is now the third biggest bubble in history. According to another, it is the second biggest bubble in history. And right on cue, Stringer announced “New York City's pension funds ended the latest fiscal year with a record-high value of $160.5 billion…The funds, which he oversees, got a 17.4% investment return for fiscal year 2014, which ended June 30. Mr. Stringer said that was one of the strongest years for the pension funds in recent times, and the annualized rate of return for the most recent five-year period is 13.4%.” Additional commentary follows after the break.

Update: New York City Police and Firefighter Pensions

|On December 20th of 2013, I published a post based on long term Census Bureau public employee pension data for the New York Police Pension Fund Article 2, the New York City Fire Department Article 1B Pension Fund, and the police and fire pension fund for New Jersey. Among its findings: the share of former NYC police officers and firefighters who were retired with disability pensions was far higher than the share for New Jersey or most other pension funds around the country with “police” or “fire” in their names. On January 7th, 2014 federal prosecutors announced “the largest fraud ever perpetrated against the Social Security disability system, a scheme stretching back to 1988 in which as many as 1,000 people — many of them officers and firefighters already collecting pensions from the city — were suspected to have bilked the federal government out of an estimated $400 million.”

Last years’ post also showed that the New York Police Pension Fund Article 2, the New York City Fire Department Article 1B Pension Fund, and the New Jersey Police and Firemen's Retirement System are deep in the hole – despite sky-high taxpayer contributions in the case of the New York City funds, contributions that drain money from other priorities. As for the other pension funds in New York and New Jersey, I have updated most of the charts with one more year of data. These charts and commentary follow on “Saying the Unsaid in New York.”

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- …

- 107

- Next Page »